Howdy and Happy Friday,

Lot to unpack this week — #4 and #5 are my favorite.

Let’s jump right in.

Remote Work Predictions

If you’re not sick of hearing/talking/thinking about remote work, check out this tweet thread on some predictions.

It goes beyond the uninventive “this pandemic accelerated what would have happened organically over the next n-years” talk track. And instead provides some really unique perspectives, in a positive light, which I appreciated.

My favorites:

Tool Experts: VP of Notion, Head of Figma, Firstbase Manager. The tools needed to effectively work remotely will lead to deep specialists inside organization who optimize the use of that product for that teams needs.

Hyper-Turnover: we are about to live through the highest period of turnover between companies in history. Workers will reorganize rapidly, choosing the workplace that suits their working style best.

City Unbundling: the allure of the city has been eroded by technology. You can easily spend time there without living there. Cost of living has made them irrational. Modern time-shares for city living, city services being distributed are inevitable.

How to Choose Projects

Film producer, Keith Calder, published what criteria he uses to choose projects.

I thought the list was super insightful in the ‘business world’ and in ‘life’ too. Reminiscent of Ikigai, which I’ve talked about before.

Wisdom on Investing

As I’ve started to dabble in investing — and really, as I’ve started to see years of investing (aka patiently waiting) paying off (h/t to Compound Interest) — I’m starting to study the best practices around investing. Many are well-known and not revolutionary. But as a total noob, I’ve enjoyed the nuggets of wisdom, especially the ones that are counter-intuitive.

Below are several of the “26 of the most important lessons from the last four decades of Berkshire Hathaway’s shareholder letters,” a list put together by CB Insights. ^ Full list of lessons linked above.

S&P Up, USD Down

Okay, so the S&P 500 hit an all-time record this week.

Literally, the highest it’s ever been in history ($3,389.78). And it’s still hovering around that amount, as of the time of writing this. They hit this milestone, thanks in part to Apple, who, on Wednesday, became the first company ever to hit a $2 Trillion market cap.

However, the US Dollar is at a 27-month low right now.

As Robinhood’s “Snacks” put it today:

Say a jar of Nutella costs €1. A year ago, €1 equaled $1.10. Today, €1 = $1.19. You're spending 9 cents more to nab the same jar of Italian decadence.

So why could this be happening? Two likely causes:

The Fed is printing money — “Money printer go BRRR”

Current instability — uncertainty caused by the pandemic, shrinking GDP and political precariousness

You could compare this to a stock split. Basically, it’s a wash. I’ll explain using a real example:

Tesla announced a 5-way stock split last week. If you own 1 share of Tesla, currently worth ~$2,000 (which is an all-time high), you will soon own 5 shares, worth $400 each. So you won’t own more value, even though on paper you own more shares.

TLDR: if you’re looking at your stock portfolio and celebrating, think twice. The dollar is less valuable, so it’s likely you’re not up as high as you think. Sorry! Don’t shoot the messenger.

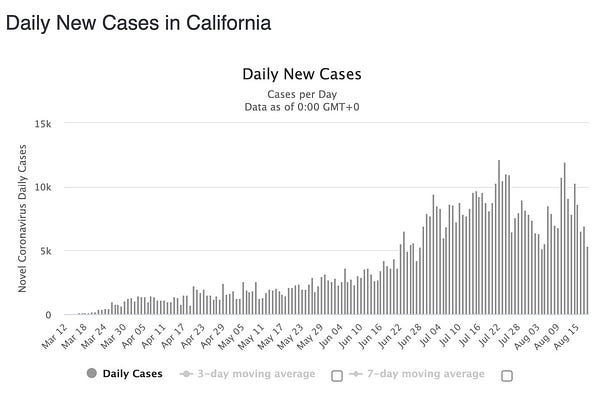

California 😬

As a California resident, there’s a lot of talk about the current state of the… state.

And just for the record, I absolutely love California.

Anyway, after a rough week for CA, this tweet sums it up. Silver lining? At least for these fires, we already have masks for the smoke.

Heading into the weekend, I’ve got this quote swirling around my head:

The capacity to learn is a gift; The ability to learn is a skill; The willingness to learn is a choice. - Brian Herbert

I’ve enjoyed trying to “learn in public” through this little Newsletter.

Thanks for following along and being a part of my journey. As always, feedback is welcomed and encouraged. And feel free to forward this email along to some friends if you enjoyed reading.

Cheers,

Brendan J Short