Hey y’all!

My goals with this post are straightforward, albeit delicate:

Help others.

Guide folks who may not be investing yet.

Help myself, by getting feedback from others.

Air out my dirty laundry so that smarter people (I’m looking at you!) can reply and help improve my thinking on investing.

Help myself, by leaving bread crumbs for my future self to learn from.

Put my thinking on paper so I can reference in the future and improve over time.

ICYMI

Before we jump into investment talk, here are the headlines you may have missed this week.

Hard to keep up. 2021 has got my head spinning faster than ever before. Fun fact: earth spins at 1,000 MPH. Wild, right? It’s real, Google it. So technically, we are, quite literally spinning, very fast, right now.

• SpaceX raised $850M from Sequoia at a $74B Valuation

• Bitcoin hit a $1T Market Cap for the first time ever; eyes Gold next, at ~$10T market cap

• Zuck played “chicken” with our friends Down Under; he did not back down

• Ted Cruzed down to Cancun to flea the devastating winter storm that hit Texas

• NASA launched Perseverance, an “alien-hunting self-driving car”

• Why is going to Mars a big deal? Here is one incredible answer; h/t Tom for sharing

• Roaring Kitty testified before Congress Thursday; highlights included his poise describing his meager upbringing, and saying: “I am not a cat” and “I like the stock”

Alright, let’s get into this week’s topic.

Money is a taboo topic.

I keep thinking about publishing something on investing, and then I don’t. Why? Because of the vulnerability and liability.

Do your own research. This is not financial advice. I simply want to get my thoughts on paper, so that in five or ten years, I can read it and improve my thinking. “What isn’t measured, can’t improve.”

Here is what I’ll cover today.

The current environment

Investment strategy resources

My personal investment thesis

My current portfolio

Considerations for investing in February 2021

1/ The current environment

Everyone is a genius in a bull market.

-Mark Cuban

You’ve probably seen this meme. It’s telling of the current times. But let’s get into some specifics.

The market has been hot the last decade. And, to the surprise of many, Covid only fueled the already-raging fire. I don’t want to ignore this fact.

I’m not some guru who thinks that my gains are some anomaly. If you have had money in the market, you probably are up too. Potentially, a lot. But just how good has the market been over the last ~decade?

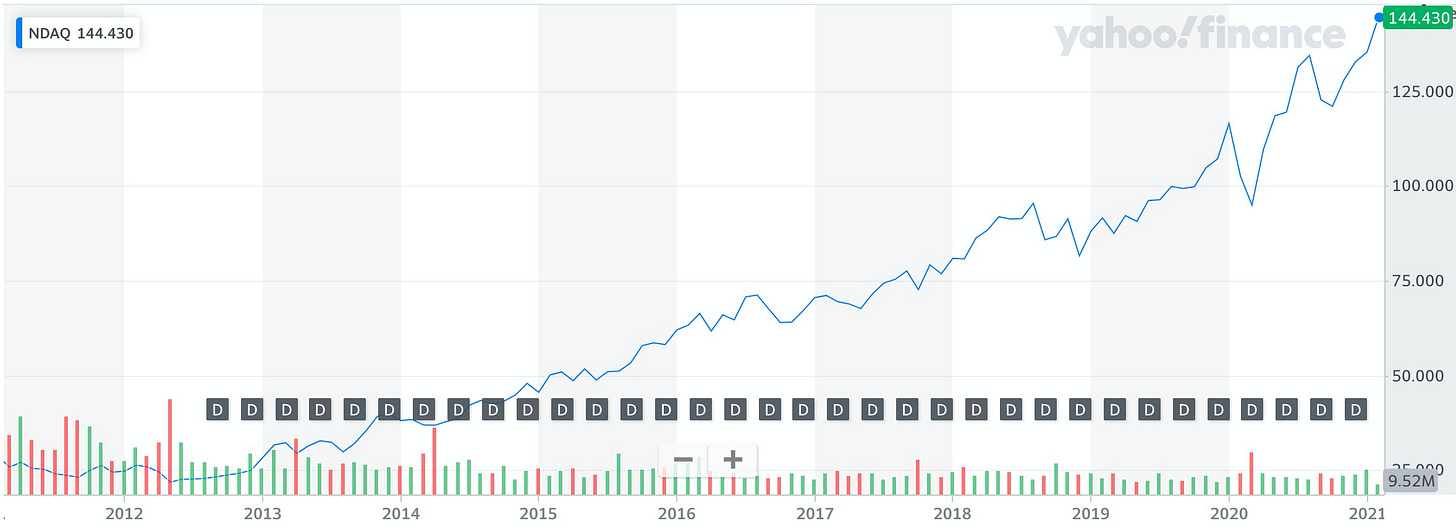

The S&P 500, over the last ten years (notice the big dip in March 2020, from Covid):

$130 per share to $390. Roughly a 300% increase in ten years, or, ~15% annual growth. The historical average is ~10% annual growth.

The current bull market is also the longest on record. “It started in March of 2009 and has been fueled by record-low interest rates and the easy monetary policies adopted by central banks which has made it cheap to borrow money.”

So this current bull-run has been both higher returns than normal *and* longer than normal.

And generally, Tech has been one of the best performing sectors, especially in 2020, due to Covid. Big Tech, even more so.

The tech-heavy Nasdaq went from $30 to $140 per share in the last ten years. A clean and impressive 500% increase over the last decade.

2/ Investment strategy resources

I personally have not read a bunch of investment books or blogs. I’ve dabbled a bit. I bought The Intelligent Investor and haven’t gotten through it. The thing is an intimidatingly dense brick of knowledge. I have watched several Warren Buffet and Charlie Munger Youtube videos. And I cannot recommend Ray Dalio’s book, Principles, enough.

Ramit Sethi wrote a much more approachable book (warning: lame title) called I Will Teach You To Be Rich. There are a few reasons I like this book.

It’s simple, without too much jargon.

He focusing on automation, which I’m all about. I don’t actually want to spend much time thinking about investing, I want to have a set-and-forget strategy, where I can build a plan and then just let things happen automagically in the background. This also means that my procrastinating-self will be thankful for setting up, for instance, an auto-deposit into my retirement account (out of mind, out of sight!).

Ramit emphasizes freedom. Dave Ramsey also does a great job at this. Here is a great summary, on the Amazon listing for Ramit’s book: “Buy as many lattes as you want. Choose the right accounts and investments so your money grows for you—automatically. Best of all, spend guilt-free on the things you love.”

I am curious about companies, industries and trends. And yes, I like to capture some value, by way of buying stocks when I see something that others may not yet see—this is the basic definition of an underpriced asset. But, at the end of the day, I don’t want finance—especially budgeting and the “boring” (smart) investments—to occupy too much of my headspace.

You won’t get rich from your salary

You’ve probably heard this before. But why is it true? Couple things.

One, there is a ceiling. Your pay is always going to be tied to your time.

The other reason is that, typically, as people gradually make more money, they, also gradually, spend more money. I’ve observed this in myself, first-hand. Sometimes it’s conscious. Other times, it’s not. But it happens. That coffee you used to make every morning at the office, starts to be a $5 coffee at the shop around the corner. That $15 haircut turns into the $50 haircut at the hip new barbershop. Clothes. Food. The list goes on and on.

So, you need to think about multiple income streams and “having your money work for you.”

3/ My personal investment thesis

Invest in things you understand

I got lucky. I have been living and breathing tech for the last decade, here in San Francisco. That’s the space I understand, so that’s where I find opportunities to invest.

Deploy capital

Put your money to work. Don’t just let it sit there or it is quite literally, just depreciating.

Note: now is when I’m acknowledging that if you have extra money to invest, that’s a huge blessing. Truly.

Assess risk tolerance

The biggest consideration is how much risk you want to assume, and what to invest into, based on the amount of risk you want to assume.

Here are some examples of ways to invest, along the “risk barbell.”

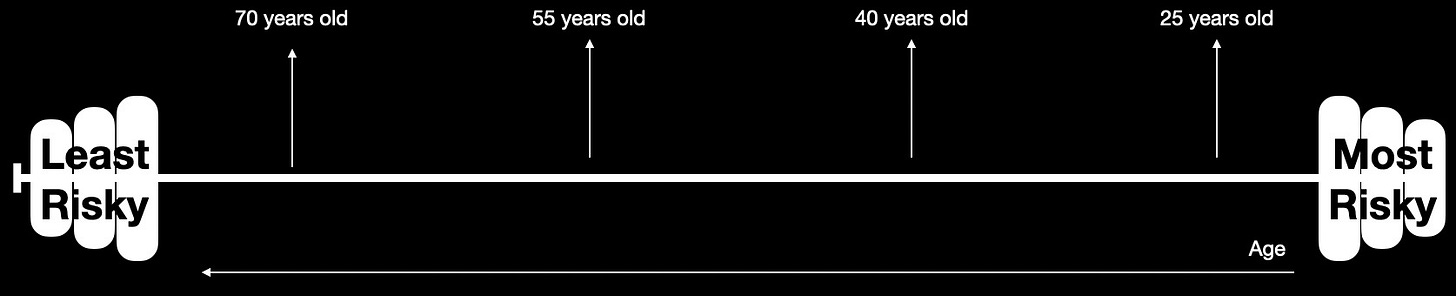

Another simple way to look at this: as you get older, you should be adjusting your risk profile on a sliding scale, and taking less financial risk.

Giving back

Something that is super important to me and my wife is giving. Obviously, where you give, is up to you. But I’d encourage anyone to consider this as part of your investment strategy.

We give to a couple different charities. One of my favorites is IJM.org. “International Justice Mission is a global organization that protects people in poverty from violence. We partner with local authorities in 20 program offices in 13 countries to combat trafficking and slavery, violence against women and children, and police abuse of power.”

At the end of the day, I see money as a gift. Especially as an American, I am already in the top percentage of wealth in the entire world. Distributing that wealth and giving back, before going out and buying more things, is a priority. I hope that continues to be the case for my whole life. Building the muscle early and consistently is crucial.

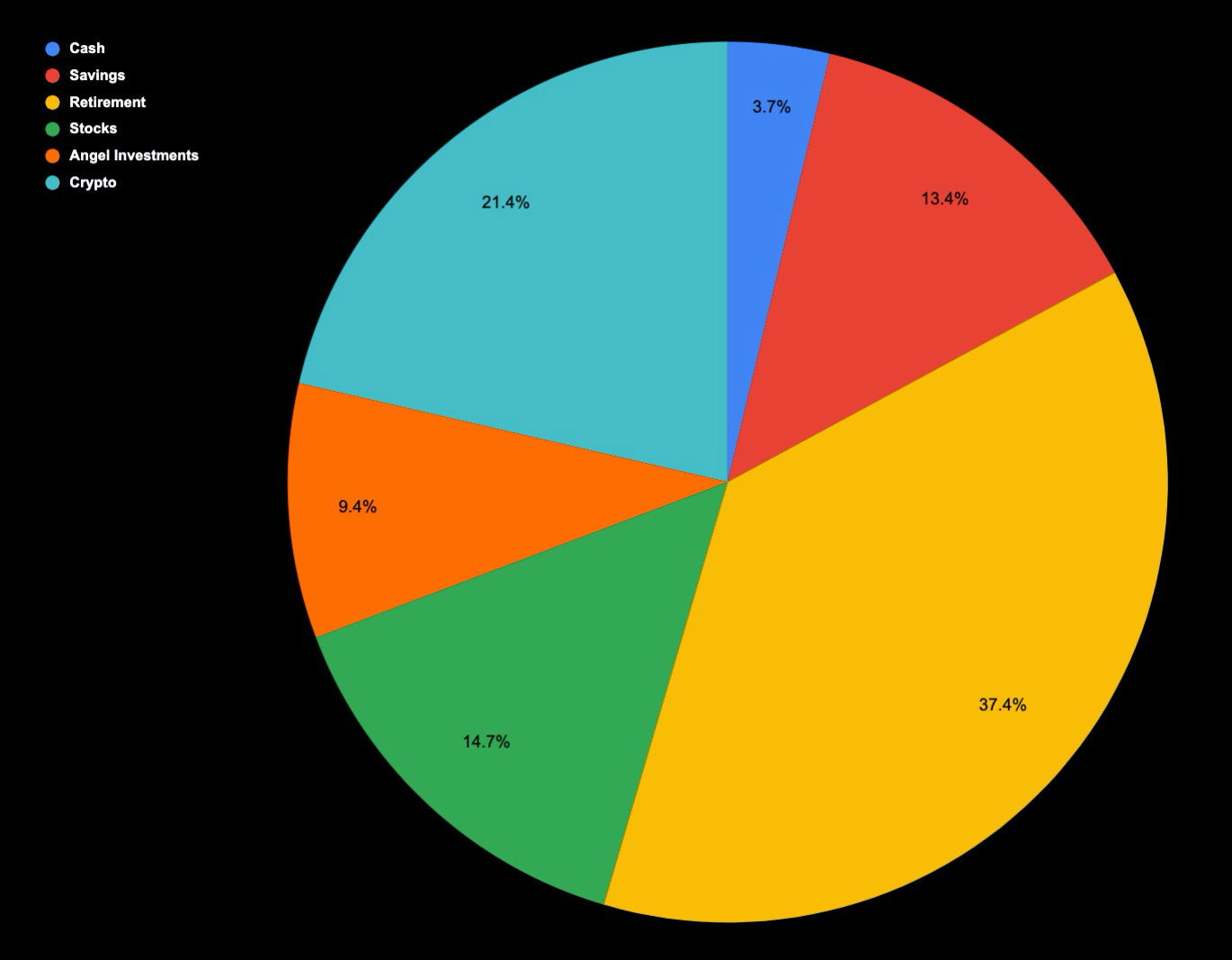

4/ My current portfolio

Alright, let’s get into the juicy parts.

Let me set the stage. I am married, no kids, and don’t own a home, yet. So I would consider my risk profile as “very risky.” If a portfolio risk-meter was equated to a wildfire risk-meter, Smokey the Bear would probably have me on his watch list.

Without further adieu, here is my current portfolio:

Like I said, this is a very risky portfolio. Would love your thoughts. What looks good? What looks off? What would you change? I’m all ears!

Rebalancing

Something I’ve done a very poor job of is rebalancing my portfolio over time. Frankly, I am just now starting to think about “targets” to even have the ability to rebalance against. Crypto is a great example of something that has accidentally grown in percentage the last couple years. So if I had a target of 10%, when it to 20%, I should have sold off the rest and rebalanced.

Beyond this simplistic understanding, I’m pretty blind on this topic. Thoughts and/or resources here are very welcome.

5/ Considerations for investing in February 2021

There are two narratives that keep rattling around in my head. I consider them the devil on my left shoulder, and the angel on my right shoulder.

😈 “Put your money to work. Inflation is happening fast. Don’t miss out!”

Along these same lines, here is a wild tweet that I linked to last week, and can’t stop thinking about it.

If inflation is happening—remember, once the government hands out the next $1.9T, they will have increased the US dollar supply by 40% in a 12 month period—then equities will simply continue to go up. Only time will tell, of course. But, in theory, this makes total sense to me.

Then my little friend on my right shoulder chimes in…

👼 “Be safe. This is an unsustainable bubble. It’s all going to come crashing down any day now.”

Most days, I don’t know which voice to listen to.

This is where goals come into play. It’s a super important point. Your short and long-term goals should drive your investing decision-making. For instance, I personally think that this crazy, risky, unpredictable asset called Bitcoin (which I wrote about here: Should You Buy Bitcoin?) is going to be more valuable in ten years than it is today. So I am buying/holding that. But, it’s insanely volatile. So I’m only buying/holding with money I am legitimately okay losing. It could start its 80% descent tomorrow. Who knows. This is a long-term, highly speculative play.

Table stakes

Having savings, or a safety net, should be rule number one.

If you don’t have that, investing into any sort of asset is probably not wise. That said, I do think that it’s smart to start thinking about investing now, even if you aren’t investing yet. Or if you’re only investing small amounts of money.

Figuring out your risk tolerance and how different assets work, is the biggest part of success.

/End

Good luck out there.

And, may the odds be ever in your favor.

How did you feel about this week’s post?

(100% anonymous)

Thanks for learning alongside me. I hope this was helpful.

See y’all next week, ideally with better weather from Mother Nature!

If you enjoyed this post, or have feedback, reply to this email! I personally read all the replies, no one else can see them.

You can also use the Google Form, linked above, and include a note. Just remember, those comments are anonymous.

If you think someone would enjoy reading this post, please forward it along to them!

Cheers,

Brendan J Short