Hi Y’all,

Welcome to those of you who are new. Last week was the biggest week of growth for this humble newsletter. Thanks for choosing to hang out with us, in this corner of the internet.

We made it to February. But it sure feels like we lived an entire year in just this last month.

The tech scene covered a lot of ground last week alone. After a fun distraction of #BernieMemes, we learned: Clubhouse was valued at $1B with only 2M users, a16z launched a media business, Chamath announced he’s running for Governor of CA (I bet he wins), Twitter bought a Substack competitor, and last, but far from least, the story we’ll unpack today: “Wall Street Bets” makes a stand against “Wall Street,” by way of GameStop.

Note: I am admittedly in over my head, once again, on this week’s topic. I don’t know much about stock trading. But I’m learning! Corrections, comments and resources are all welcome. Thanks in advance for your grace.

I’ll give an overview of the different storylines at play. Then, at the end of the post, I’ll leave you with a curated feed my favorite Twitter takes. Some will be serious and helpful. Others will be silly and entertaining.

I hope you enjoy “What I Learned This Week.”

Below is my “Table of Contents”, in timeline form, based on the events that unfolded last week.

Backstory

In order to give the full context of what happened this past week, I’d have to explain—oh, and first learn—a ton of wildly complex intricacies of how the stock market works.

My friend Kyle put it succinctly:

Bottom-line: there was a group of people who saw an opportunity to make money, and fight back against “the establishment,” in one fell swoop. Two birds, one stone (trade).

This has been brewing for a few months. We’ll get to that a little further down. First, let’s intro the antagonist of our story:

r/wallstreetbets

The subreddit, /wsb, for simplicity, was created in January 2012, self-described as:

Like 4chan found a bloomberg terminal.

I mentioned /wsb back in June, when Hertz spiked 680% in under two weeks *after* Hertz had already gone bankrupt. In June /wsb had 1.25M users. Today, they have 7.7M, adding over 5M users in the last 10 days, alone. And growing about half a million users per day. That’s unprecedented growth for a subreddit.

So, who are these people?

Well, that’s the interesting part.

First of all, no one really knows. Because, on Reddit, you’re able to use a pseudonym (just a username name and an avatar). By the way, I think this is the future. You still have to play by the rules outlined by Reddit and the moderators (aka mods) of any subreddit you join.

Secondly, with millions of users, there are plenty of newbie traders who should not be day-trading. But there are also, undoubtedly, very smart people.

Okay, let’s get into the “cause” that they are all fighting for...

Stick it to “The Man”

You can read the full timeline of events leading up to last week here. This is the TLDR:

Things snowballed, and last week, things got really crazy.

I made a GIF to explain what happened. It starts with: “The game was rigged in Wall Street’s favor”:

In July, a reddit user by the name of “u/deepf***ingvalue” posted an analysis on his YouTube channel, where he goes by “Roaring Kitty.” Part of the video exposed that a few hedge funds were “short” on GameStop’s stock. This started out as a genuine trade. He believed the long-term fundamentals of the business were undervalued.

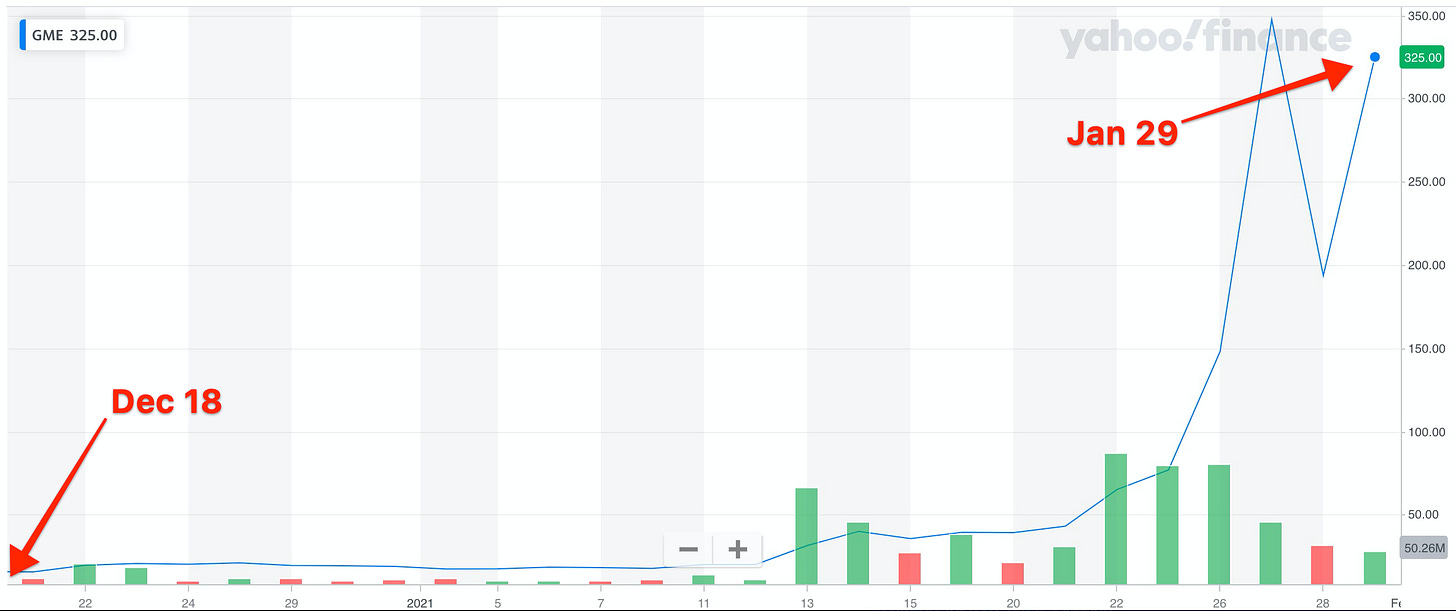

$GME was at $4/share when he published the video. Fun fact: this was the first video he ever published.

He posted it to /wsb. And other users slowly started to pile on. This drove up the stock price. Which meant the “short sellers” (aka hedge funds aka “Wall Street”) wouldn’t make profits on the trade, as long as the /wsb traders could hold out.

In early January, the former founder of Chewy.com joined GameStop as a Board Member, showing real promise for a turn-around story.

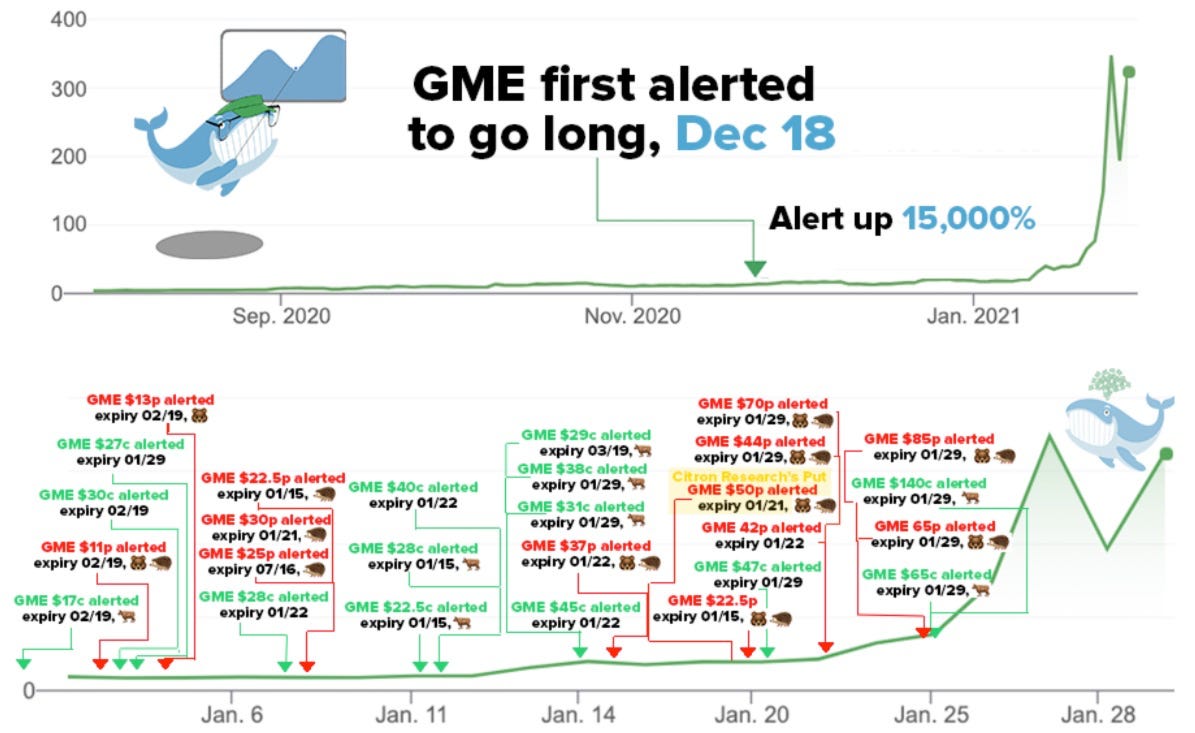

This slowly built momentum into last week. Here is the stock chart from just Dec 18 to Friday last week, leading up to the “short squeeze” (the climax of our story).

Last point here, but an important one, surfaced by Alexis Ohanian, founder of Reddit. I recommend reading this gut-wrenching story which exposes the disconnect with “Main Street” and “Wall Street.”

Stick to “The Memes”

The internet took this thing and ran with it.

So much so, that I can almost guarantee anyone reading this has already heard about GameStop last week. Well-known voices chimed in:

And folk from all around the world started jumping in too. It went properly “viral.”

Then, Thursday morning happened.

Robinhood

If a product is free, you are the product.

This is the case for Facebook, Google Search, and yes, Robinhood. Turns out, they were right when they told us “there’s no such thing as a free lunch.”

Thursday morning, Robinhood (and a dozen other platforms) shut down the ability to buy certain “meme stocks.” Robinhood was the #1 app on the app store for the last week (insane). It was the go-to trading platform for a large percentage of /wsb. And overnight, Robinhood seemingly betrayed that community.

The full story will be unraveled in the weeks and months to come. But what we know now is that the float required was too big for Robinhood to cover. So they raised $1B overnight, and decided to de-risk their business by closing the ability to buy certain stocks. You can watch their CEO’s interview from Thursday, here. And then you can read what he should have said.

Since this incident, companies like Public.com have decided to shut down their Payment for Order Flow (PFOF) business. Instead, they’ve introduced tipping, trusting the community will pay (similar to ride sharing or food delivery monetization models). I’m not convinced this will work. It feels a bit too altruistic. But I appreciate their optimism, and I hope it works!

Censorship also bubbled back up:

And hey, if Ted Cruz and AOC can agree on something, it’s worth taking notice!

Bloomberg had a great overview, worth reading: How Will the GameStop Game Stop?

Crypto

The crypto world took the opportunity to chime in.

Pomp’s take: The Game Has Changed.

And more generally, decentralization was the story the crypto world was discussing. Another perspective here.

Think about it: decentralization allows for Twitter/FB, AWS, Hedge Funds, or the SEC for that matter, to no longer be required as a middle-man.

What’s Next?

Here is the full playbook to gamma squeeze $GME.

It’ll be interesting to watch this continue to unfold, especially given the current uncertainty in the broader markets. Trillions of dollars are about to be pumped into the economy (again), and yet many businesses are still feeling the repercussions from Covid last year.

Here are my personal takeaways—I’m optimistic:

There has never been more access to information, for anyone who seeks it out.

Commoditization of information is a great thing.

There has never been more technologies that level the playing field.

Cutting out the unnecessary middle-man (“gatekeepers” and “tax collectors”).

As long as we can allow the markets to decide what is right and wrong, by getting out of the way, I see this as another eye-opening event that puts the power into the hands of individuals, not centralized authorities, be those governments or private companies.

The sum of the decentralized many is greater than the sum of the centralized few.

This is a story of the internet, so I’ll let “the internet” make the closing thoughts.

See y’all next week.

Twitter Round-up:

How did you feel about this week’s post?

(All feedback is 100% anonymous)

Cheers,

Brendan J Short